Ron Baron's Tesla Stance: Opportunity or Overconfidence?

Ron Baron's Tesla Bet: Genius or Reckless? A Data Dive

The Baron of Bull: Tesla's Biggest Believer

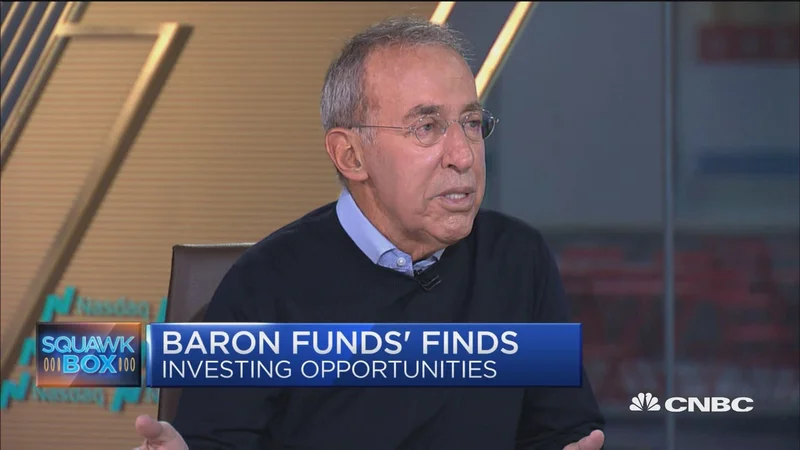

Ron Baron, the billionaire investor, isn't just bullish on Tesla; he's practically stapled his portfolio to Elon Musk's rocket ship. He's publicly stated he won't sell his Tesla or SpaceX holdings ever, and that roughly 40% of his personal net worth is tied to Tesla alone. He even claims to have already made $8 billion from an initial $400 million investment. It's a compelling narrative, but let's dissect the numbers.

Baron's long-term faith in Tesla isn't new. He's been touting the stock for over a decade. But is this conviction based on sound analysis, or is it a case of being too close to the flame? He suggests Tesla could become a $10,000 stock within a decade, banking heavily on ventures like robotics (specifically, the Optimus robot) to fuel that growth. The prediction hinges on Musk delivering at least a five- to seven-fold gain. Is that realistic, or is it optimism bordering on delusion?

Robotics: The Wildcard in Baron's Hand

The linchpin of Baron's argument seems to be Tesla's move into robotics. He points to Musk's claim that Optimus could be Tesla's most valuable product. Baron even stated that Tesla is building production capacity for one million robots next year (2026) and 10 million the year after. But where are these figures coming from? Musk's shareholder presentations, sure, but what's the verifiable data backing this aggressive ramp-up?

That's the question that keeps me up at night. I've looked at hundreds of these filings, and this kind of forward-looking production projection, especially one so dependent on unproven technology, is unusual in its… audacity. We're talking about a company that has, at times, struggled to meet production targets for its cars. Now, they're aiming to mass-produce humanoid robots? It feels like a different kind of bet altogether.

Wall Street's analysts, for their part, aren't entirely convinced. The consensus rating for TSLA is a "Hold," based on 34 analysts. This includes 14 "Buy" recommendations, but also 10 "Hold" and 10 "Sell." The average price target sits at $382.54, which actually implies a roughly 5.58% downside from current levels.

Is Baron Simply Too Deep to Back Down?

Baron's strategy is highly concentrated, with 25% of his personal wealth in SpaceX and another 35% in his own Baron mutual funds. That's a massive commitment to two companies led by the same individual. It raises the question: is Baron truly analyzing Tesla objectively, or is he now so heavily invested (emotionally and financially) that he needs Tesla to succeed to validate his own investment thesis? He recalls a promise to his fund's board: he'd be the last person to sell Tesla stock. That's a powerful statement, but it also suggests a potential blind spot. A good investor knows when to cut losses, even on their "pet" stocks. Is Baron prepared to do that, or is his legacy now inextricably linked to Tesla's fate? Investor Ron Baron says the tech selloff is an opportunity and he’s never selling personal Tesla stake

The Kool-Aid Effect

Baron's unwavering faith could be a case of what I call the "Kool-Aid Effect" – becoming so immersed in a company's narrative that you lose sight of the underlying risks. He's clearly bought into Musk's vision hook, line, and sinker. While that vision could materialize, the probability, based on available data, seems far lower than Baron suggests.

So, What's the Real Story?

Baron’s Tesla bet looks more like a legacy play than a data-driven decision.