MP Materials Stock: The Next Nvidia? What Investors Are Watching

MP Materials: The Nvidia of… Mining? Buckle Up.

Okay, folks, let's talk about MP Materials. I know, I know, mining isn't exactly the sexiest topic. We’re much more likely to get excited about AI, but hear me out. Because what's happening with MP Materials, this little rare-earth mining company, is nothing short of a potential paradigm shift. Could it become the Nvidia of the materials world? Well, let's dig in – pun intended!

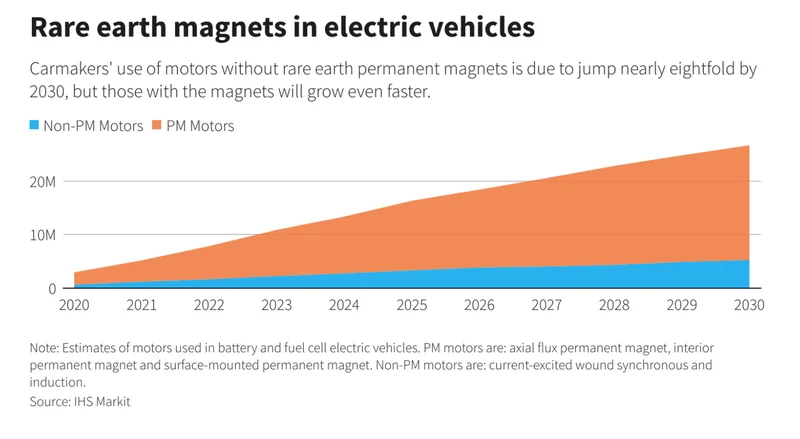

Right now, think about your phone. That sleek, powerful device in your pocket wouldn't exist without ridiculously strong magnets made from rare-earth metals. And those magnets? They're everywhere. Electric vehicles, wind turbines, even your kitchen blender – all depend on these critical components. MP Materials, sitting on its Mountain Pass mine in California, is positioned to be a major player in supplying these essential materials, especially here in the US.

The comparison to Nvidia isn't as crazy as it sounds. Nvidia's dominance in chip design has made it practically synonymous with the AI revolution, and its chips are in high demand. MP Materials is facing a similar situation because the Mountain Pass mine is one of the few scaled sources of rare-earth metals in the United States. China's control over the rare-earth market makes MP's domestic production even more critical. This scarcity, this strategic importance, is why MP stock has exploded, and why the US government is investing heavily in its future.

A Different Kind of Tech Story

But let’s be real, MP Materials isn’t exactly Nvidia. Nvidia is a high-margin tech company riding the AI boom. MP is a mining company, with all the capital expenditures and commodity cycle risks that come with it. Nvidia is already raking in the cash, while MP is still building its second magnet factory, the "10X Facility," which should eventually boost revenue and cash flow. It's like comparing the California Gold Rush to the dot-com boom – both are about opportunity, but the execution is vastly different.

Morgan Stanley, in its analysis, maintains an "Equal-weight" rating, acknowledging the long-term potential but also highlighting project execution risks and rare earth price volatility. That's a fair assessment. Analyst Carlos De Alba points out that MP's plan to start commercial production of permanent magnets by the end of 2025, used in "critical military platforms and green energy applications like EVs, wind turbines and humanoids/robotics," is a huge step. The partnership with the Department of Defense further de-risks the business model, which is a smart move. As reported by Investing.com, Morgan Stanley weighed in on Is MP Materials stock worth owning amid rare earth volatility? MS weighs in By Investing.com.

However, the risk of execution is real. Can MP scale up magnet production efficiently? Can it navigate the volatile rare-earth market? These are big questions. And while the potential upside from recycling is exciting, it's still a future possibility, not a current reality. To reach Nvidia's valuation, MP would need to climb something like 44,900% from today's price. Think about that for a second. It's a massive challenge, but that doesn't mean it's impossible to succeed.

What’s really exciting, though, is the potential for MP to become a cornerstone of a truly independent American supply chain for critical materials. Imagine a future where the US isn't reliant on foreign powers for the building blocks of its technology. That's the promise of MP Materials, and it's a promise worth investing in. This isn't just about mining; it's about national security, technological independence, and a sustainable future.

I saw someone on Reddit put it perfectly: "MP Materials is more than just a company; it's a strategic asset." That really resonated with me, and it sums up the broader feeling I'm seeing in the community.

Of course, with great power comes great responsibility. As we develop these technologies and secure our supply chains, we must also be mindful of the environmental and social impacts of mining. Sustainability and ethical sourcing need to be at the forefront of this revolution.